Green Investing's Values Test Amid the Storm

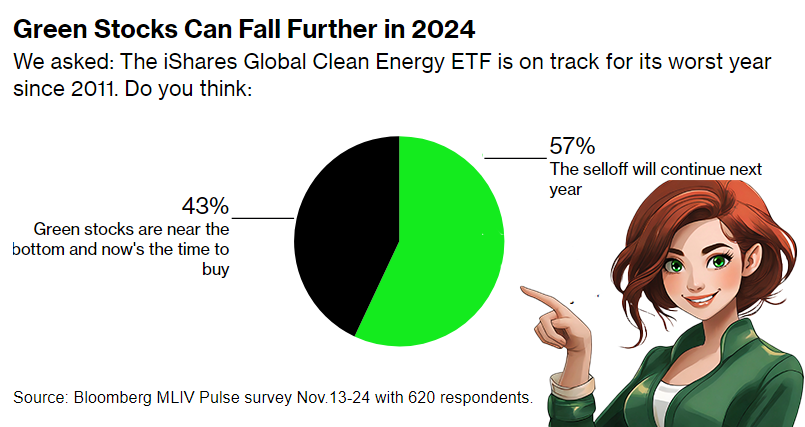

The latest survey reveals a profoundly gloomy near-term outlook on climate solutions stocks. Yet growing global urgency around emissions reductions continues to steadily mount pressure on corporations to address sustainability issues and contribute towards decarbonization goals.

The latest survey from Bloomberg MLIV Pulse, reveals a profoundly gloomy near-term outlook on climate solutions stocks. Yet growing global urgency around emissions reductions continues to steadily mount pressure on corporations to address sustainability issues and contribute towards decarbonization goals. How can businesses reconcile volatile valuations with intensifying world government and consumer pressures?

The core driver lies in a disconnect between short and long-term value creation paradigms. Currently, public markets overwhelmingly emphasize immediate financial returns, causing abrupt selloffs when macro-economic conditions cloud profitability projections. However, the exponentially rising costs of climate inaction make business models ignoring environmental and social externalities inherently fragile.

As analyst Maggie O'Neal explained, "2023 appears likely to be the warmest year on record, and 2024 potentially being similarly hot." Every incremental temperature rise escalates climate vulnerability. Government accountability tied to emissions pledges intensifies amidst this backdrop, as "half the world's population will vote in elections in 2024."

From policy penalties to consumer activism, businesses failing to validate climate commitments face material risks from societal stakeholders prioritizing sustainability. Yet those strategically investing to reduce supply chain and operational emissions create resilience by aligning with the direction of regulatory and social winds.

So, while shareholders may reward climate inertia for fleeting periods, global momentum necessitates conscious corporations build long-view value models factoring in externalized costs today's profits incur tomorrow with advantage tied to foresight, ESG integration, backed by verified impact, future-proofs for the challenges ahead.

Where do you see the widest gaps between market incentives and sustainability imperatives? How can the financial and corporate sectors catalyze the cooperation needed to accelerate progress?

#ValuesDrivenCapitalism #ConsciousCorporations #ESGintegration #StrategicSustainability supplychainETHICS #BusinessCaseForSustainability

#FutureValueCreation #LongTermThinkers #TotalImpact #BeyondBusinessAsUsual #MainstreamESG #ClimateForesight

#DecarbonizeNow #EmissionsPledgePressure #VerifiableSustainability

#WalkingTheTalk #RiskAndOpportunity #ClimateResilienceInvesting

#FiduciaryDutyRedefined