Demystifying the EU’s New Sustainability Directives: CSRD and CSDDD

While CSRD and CSDDD originate out of Europe, U.S.-based multinationals have significant incentive to pay close attention even if not directly subject yet to these specific regulations.

With the EU rolling out ambitious regulations like the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD), companies (including US companies) are rightfully seeking clarity on how these intersect and what needs to be done for compliance.

What is CSRD?

The CSRD establishes comprehensive sustainability reporting standards for large EU companies across environmental, social, and governance (ESG) factors. Formalized in 2023 after the Non-Financial Reporting Directive, CSRD greatly expands mandatory disclosure requirements across GHG emissions, diversity data, governance, and more. Approximately 50,000 EU firms must begin reporting under these standards in 2025.

At its core, CSRD tackles sustainability transparency, ensuring stakeholders have reliable, comparable ESG data.

What is CSDDD?

While CSRD focuses on disclosure, CSDDD introduces legally binding due diligence requirements for companies to proactively identify, prevent, mitigate and account for human rights and environmental harms related to global operations and value chains.

Beyond just reporting, CSDDD drives corporate accountability, requiring real-world action to address social and ecological risks outside the EU. Violations could incur fines upwards of 5% of sales.

Where is Overlap?

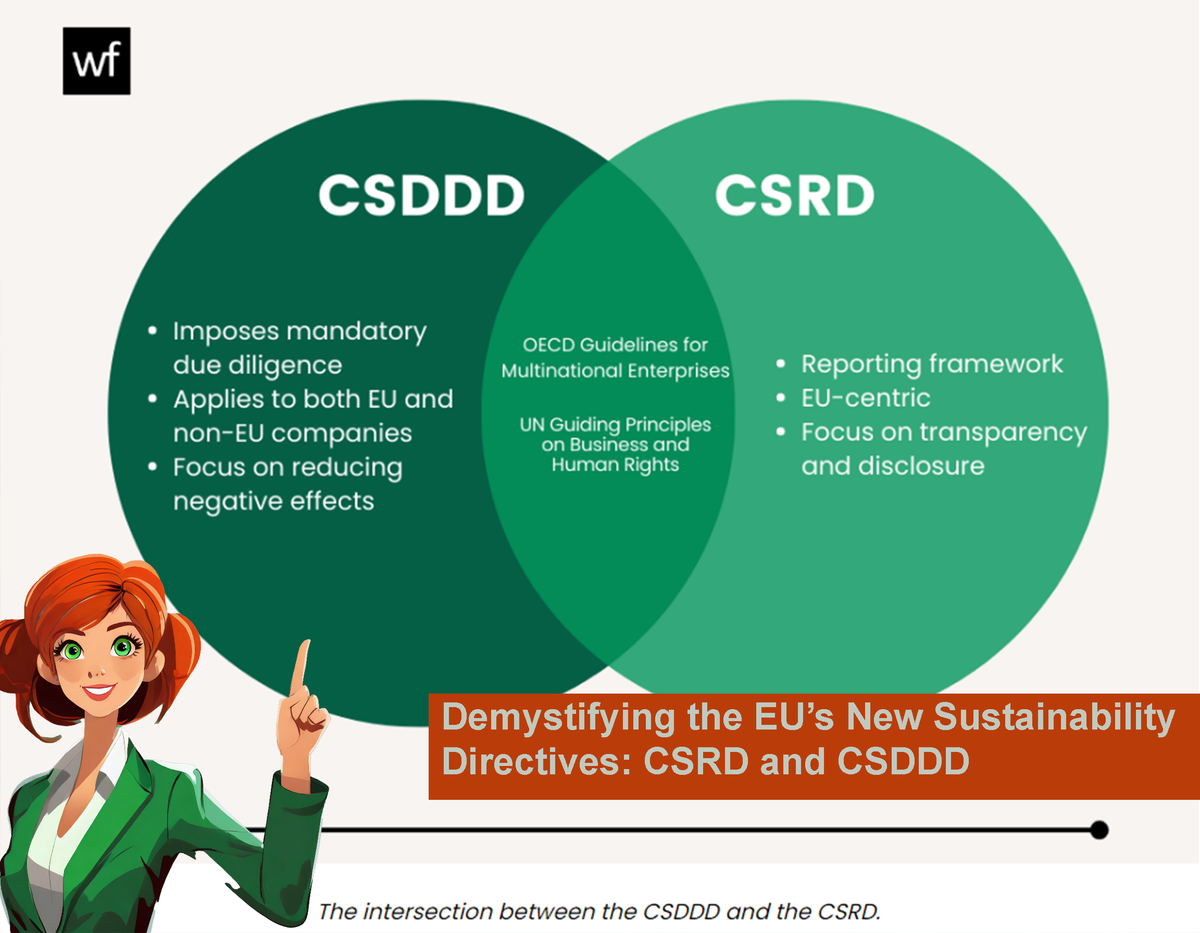

CSRDD and CSDDD play mutually reinforcing roles aligning firms to higher ethical standards worldwide – making robust reporting the baseline for demonstrating progress addressing harm over time. Think of CSRD as the “what to report” and CSDDD as the “what to fix” in the ecosystem of EU sustainability regulations emerging.

So there is certainly overlap in aims across mandatory reporting, due diligence, and tying sustainability performance to risk management. But nuances exist in geographic scope and whether directives focus more on disclosures versus demonstrated impact reduction.

Getting Ahead of the Curve

With both directives still evolving in 2023, there is a strategic opportunity for brands sourcing globally to get ahead of the curve on improved reporting and ensuring responsible, ethical practices. Contact us for a deeper dive!

How This Impacts U.S. Companies

While CSRD and CSDDD originate out of Europe, U.S.-based multinationals have significant incentive to pay close attention even if not directly subject yet to these specific regulations.

First, large American brands and retailers deeply intertwined with European partners and consumers should align on shared reporting and responsible sourcing standards where possible. Getting ahead expands opportunities.

Second, as stakeholders access more EU sustainability data, peer pressure mounts for multinationals elsewhere to keep pace. Market shifts beyond regulation alone also incentivize action.

Finally, parts of CSDDD mirror principles already embedded voluntarily in guidelines some U.S. firms adhere to already. Getting experience complying now with official EU standards also positions brands well for wherever due diligence expectations go domestically in the future.

In summary – coming EU directives impact U.S. fashion through partnerships, stakeholder pressures, market incentives, and expected policy echoes.

#sustainability #ESG #CSRD #CSDDD #reporting #compliance #fashion